Amtrak’s Fiscal Health and the Growth of NY/NJ Commuter Rail

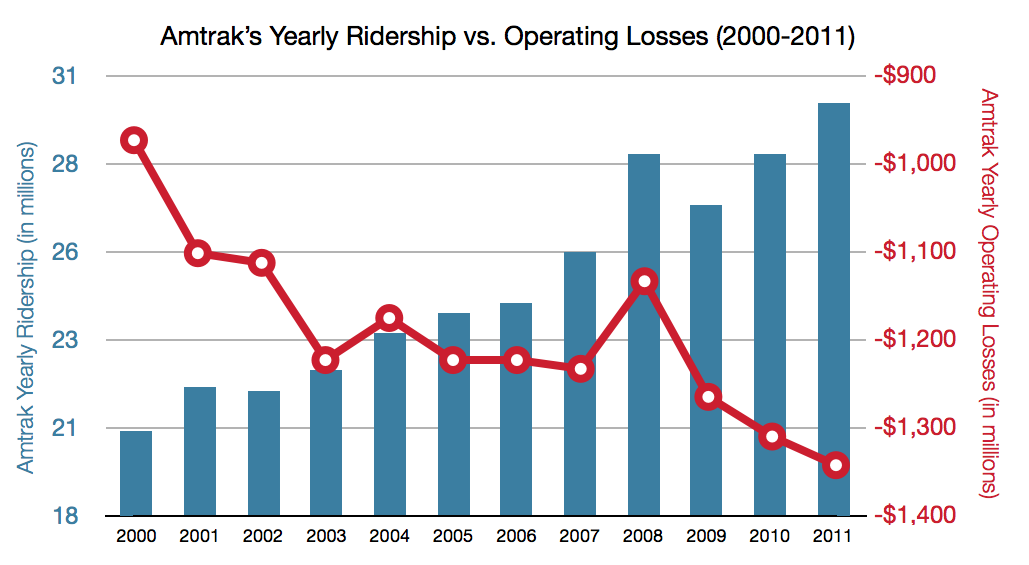

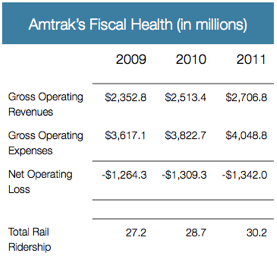

In terms of budgeting, Amtrak has, over the past three years, received federal subsidies averaging $1.5 billion and has seen ridership steadily climb from around 21 million passengers in 2000 to over 30 million passengers in 2011. However, despite this apparent growth, Amtrak has operated at an average loss of over $1.2 billion since 2009. As the chart above indicates, curiously, as Amtrak’s ridership increases, its yearly operating losses continue to grow in the negative. So what does this have to do with NY/NJ commuter rail? Amtrak owns the largest rail hub in North America and the metropolitan region’s busiest commuter rail station: Penn Station.

As New Yorkers and New Jerseyans look for a long term solution to the current capacity problems in Penn Station, Amtrak’s fiscal instability may have lasting negative effects. And as Amtrak continues to lose over a billion dollars each year, NJ Transit and LIRR would be justifiably concerned that its financially unstable landlord may be pressured to squeeze additional capital out of Penn Station in order to refinance its less successful sectors. This fear was indeed realized in 2001, when Amtrak was forced to put up Penn Station as collateral for $300 million in loan guarantees. As party politics increasingly threaten federal transportation funding, there are no assurances that Amtrak will continue to receive the vast federal subsidies upon which it relies. Amtrak may be required to raise rents, sell off transit space, or at best, just neglect to make much-needed improvements throughout Penn Station. In order to avoid these potential problems, the operator of New York’s next premiere transit hub needs to have both unified interests with the passengers it serves as well as sound financial footing.